Published on: Nov 4, 2024

by: Billy Gao (Velocity Capital & Standard Blockchain Council)

The Hanging Gardens of Babylon

The recent Bitcoin Conference 2024 drew significant attention, especially with prominent figures like Republican and independent presidential candidates Donald Trump and Robert F. Kennedy Jr. taking the stage. Bitcoin has once again become a focal point within the broader crypto and DeFi communities, and rightfully so.

Today, most DeFi projects are built on Ethereum, yet it is noteworthy that Bitcoin's market capitalization is still four times that of Ethereum at the time of writing [1]. With Bitcoin prices approaching the $70,000 mark by the end of the conference [2], its dominance is undeniable. However, this raises questions about Bitcoin's utility as an asset, particularly since it continues to rely on the proof-of-work consensus mechanism—a method that Ethereum moved away from in 2022 as part of its transition to Ethereum 2.0. It is within this context that Babylon was conceived.

Babylon Chain is a pioneering blockchain platform founded by Professor David Tse from Stanford University in 2022. It enhances the security and scalability of dApps and other blockchain networks by leveraging the security of the Bitcoin network. Babylon provides decentralized security services, making it an innovative and distinctive solution within the blockchain ecosystem. The project aims to bring the unparalleled security of Bitcoin to all Proof-of-Stake blockchains without any extra energy costs [3].

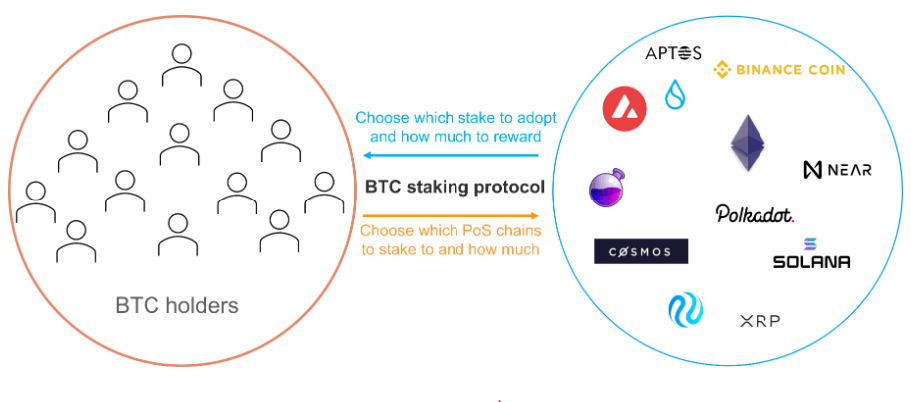

Babylon is at the forefront of Bitcoin innovation, pioneering a transformative Bitcoin Staking Protocol. While other blockchains have benefited from adopting or transitioning to a PoS mechanism, Bitcoin maintains its traditional Proof-of-Work approach, often criticized for not offering as many benefits. Babylon's staking mechanism allows participants to lock part of their tokens and earn rewards, thereby enhancing the network’s security [4]. This enables smaller and newer blockchain networks, particularly Proof-of-Stake chains within the Cosmos ecosystem, to secure their operations without directly integrating with Bitcoin.

Babylon's larger mission is to scale Bitcoin to secure the decentralized crypto economy by leveraging three primary aspects of Bitcoin: its tokenized asset, robust timestamping service, and inherently censorship-resistant blockspace [3]. To harness these characteristics, Babylon conceptualizes three state-of-the-art security-sharing protocols: the Bitcoin Staking Protocol, the Bitcoin Data Availability Protocol, and the Bitcoin Timestamping Protocol. Rather than adding new layers or building new ecosystems on top of Bitcoin, Babylon extracts security from the Bitcoin chain and shares it with various PoS chains like Cosmos, Binance Smart Chain, Polkadot, Polygon, and others [5].

Co-founder David Tse envisions a future where Bitcoin's robust security framework underpins a variety of PoS protocols, enhancing the security and stability of blockchain networks through a collaborative approach [6]. Babylon's modular and adaptable protocol design allows for integration with various PoS chains, creating a more interconnected and secure blockchain ecosystem [7]. By leveraging Bitcoin's inherent security and trust, Babylon's approach allows PoS chains to tap into a more robust and established security mechanism, using cryptographic timestamps to link the Bitcoin blockchain with PoS chains and enhance their security and trustworthiness [6].

[8]

PoS chains could as such enhance their security without directly integrating with Bitcoin, thereby stabilizing and securing the broader crypto ecosystem. Babylon transforms Bitcoin from a static store of value into an active participant in blockchain security, demonstrating its versatility and broader utility in the digital asset space [6]. The project originated from a research paper on Bitcoin security co-authored by its co-founders and other prominent researchers, accepted by the 2023 IEEE Symposium on Security and Privacy [9].

Through innovative checkpoint anchoring, Babylon Chain combines Bitcoin's strong security with the dynamic validation of PoS networks. This creates a new synergy between the two ecosystems, resulting in innovative solutions for both. Babylon's approach, particularly through its Bitcoin staking protocol, allows users to generate passive income and support the PoS ecosystem without selling their Bitcoin. By anchoring PoS checkpoints onto the Bitcoin network, Babylon creates a security synergy that enhances Bitcoin's censorship resistance and provides a new role for Bitcoin as a dynamic contributor to network security.

Babylon proposes an innovative solution to the problems posed by PoS through its Bitcoin timestamping protocol. This protocol repurposes idle Bitcoin for securing PoS chains, allowing PoS chains to tap into a more robust and established security mechanism. This strategy aids in fortifying the stability and security of PoS networks and presents opportunities for the DeFi community. Emerging applications such as cross-chain lending and yield farming combine the strengths of PoS and Bitcoin ecosystems, further integrating and securing the crypto economy [3].

Workings of Babylon

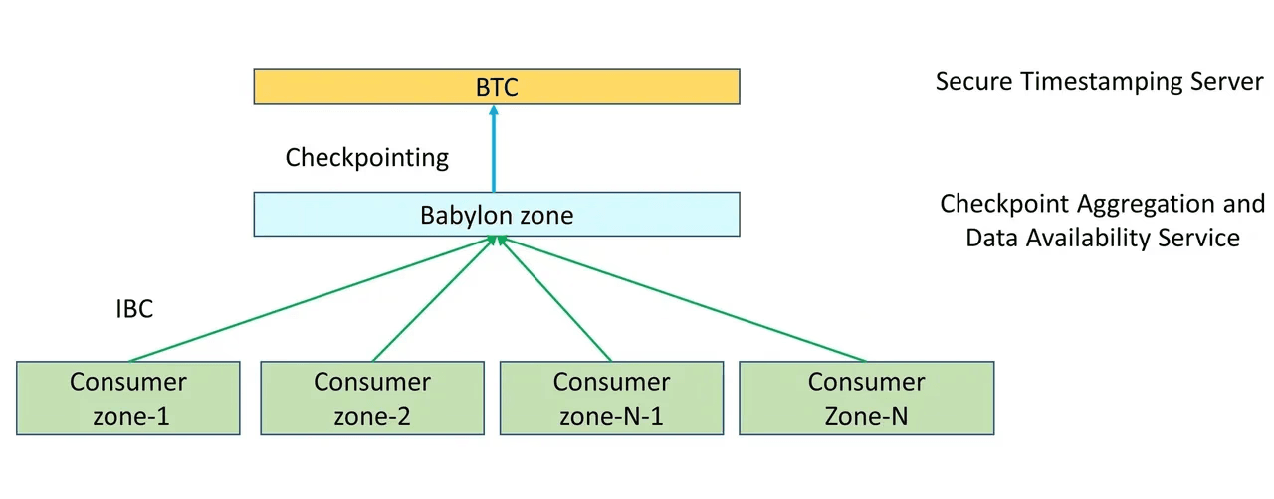

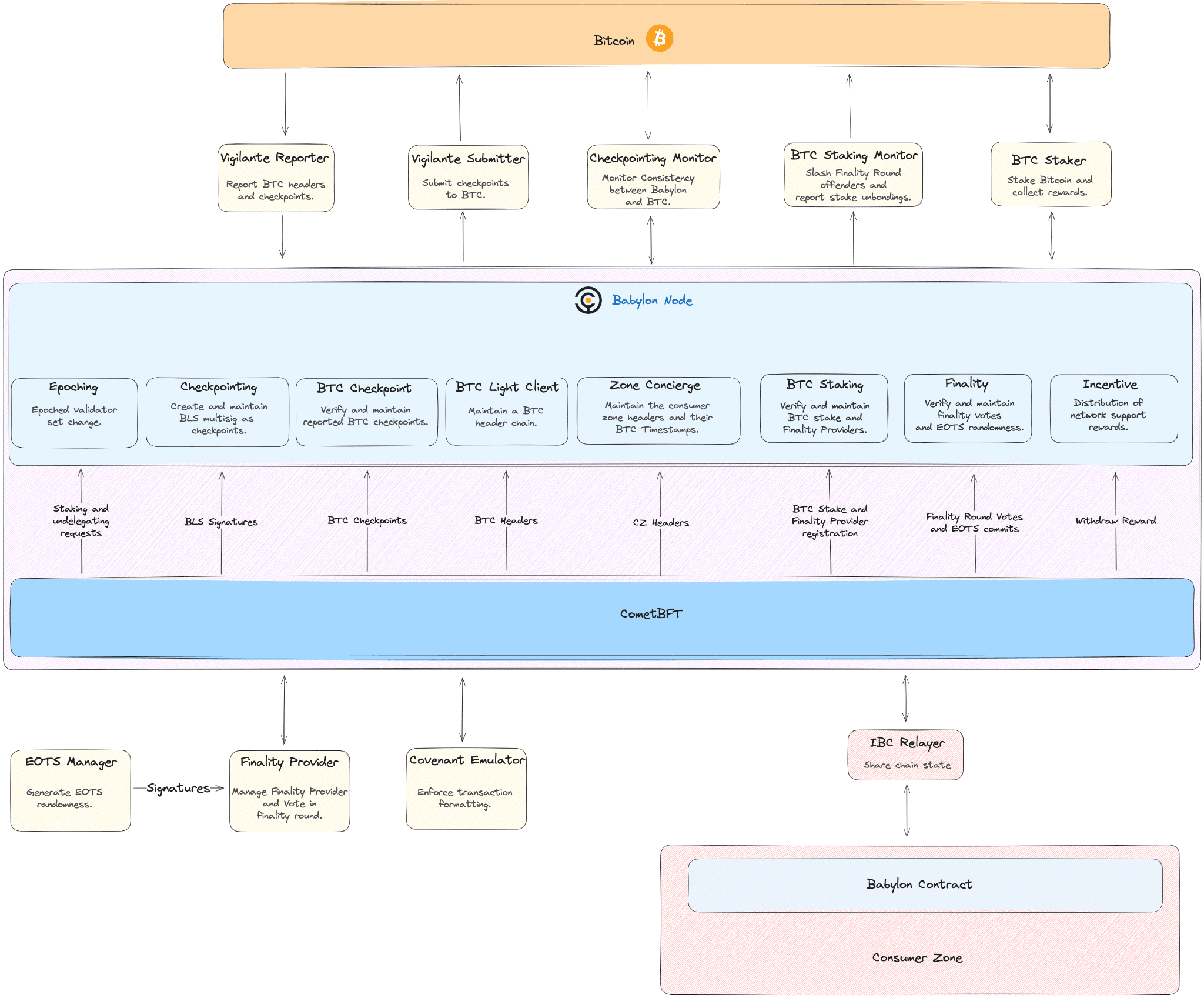

Babylon Chain leverages Bitcoin’s security by anchoring its blocks to the Bitcoin blockchain through a process called checkpointing. This integration allows Babylon to benefit from Bitcoin’s robust proof-of-work consensus mechanism, providing enhanced security for its operations. Additionally, Babylon offers decentralized security services to other blockchain networks, enabling smaller chains to benefit from Bitcoin's security without direct integration, which is particularly beneficial for enhancing these networks' security [7].

[10]

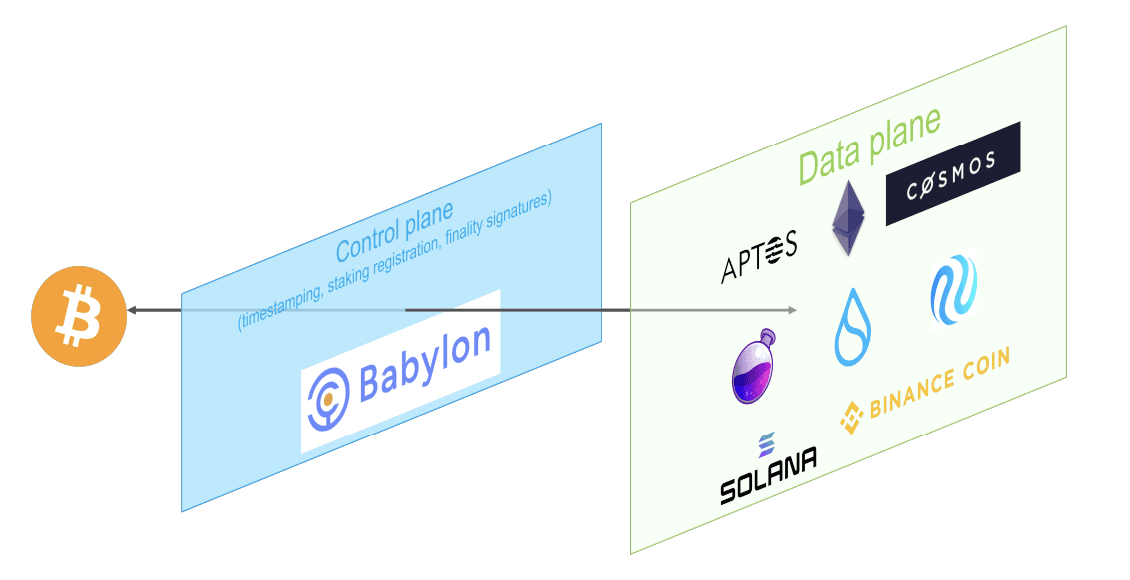

Babylon operates on a hybrid model that combines Bitcoin’s PoW and its own proof-of-stake consensus mechanisms, ensuring energy efficiency while leveraging Bitcoin's security. Checkpointing is a key component of Babylon's system, periodically anchoring its blocks to the Bitcoin blockchain to add an extra layer of security, making it extremely difficult for malicious actors to alter the blockchain’s history.

Vigilante Relayers are independent programs that relay data between Babylon and the Bitcoin network, ensuring the integrity and security of checkpointing. They include Vigilante Submitters, which submit Babylon checkpoints as Bitcoin transactions, and Vigilante Reporters, which verify and report these checkpoints back to Babylon [11]. The Monitoring Suite, including tools like the Checkpointing Monitor and BTC Staking Monitor, ensures consistency and oversees the execution of BTC staking transactions [12].

Babylon interacts with multiple blockchain networks within the Cosmos ecosystem through Inter Blockchain Communication, allowing it to aggregate and verify checkpoints from these zones, ensuring data synchronization and security across different blockchains. Babylon’s innovative approach includes utilizing 21 million idle bitcoins to bolster the economic security of PoS chains and decentralized applications [13]. Despite Bitcoin's scripting language limitations, Babylon employs advanced cryptographic technologies, such as extract one-time signature and Bitcoin’s native time-lock, to enable secure and trustless staking of Bitcoin for PoS security.

Babylon's Bitcoin Staking Protocol is a modular and scalable two-sided market where Bitcoin holders can securely lock their bitcoins to stake for various PoS chains and earn yields. PoS chains and dApps can opt-in to bitcoin-backed security, enjoying high security, healthy economics, and broader adoption. This protocol eliminates the need for bridging, pegging, or transferring bitcoins to third-party custodians, enhancing security and efficiency [14].

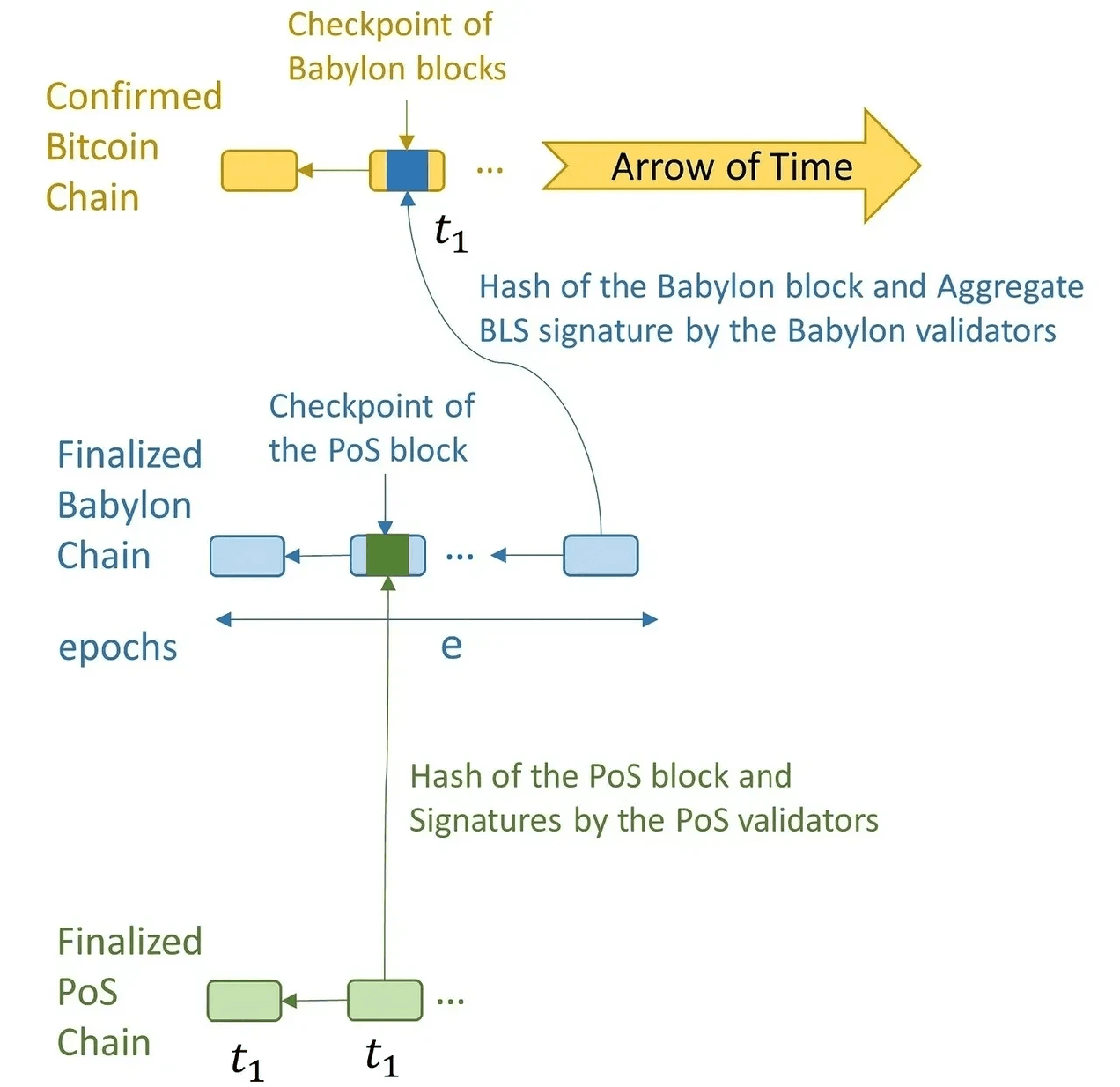

Babylon’s Bitcoin Timestamping Protocol enhances the security of PoS chains by checkpointing events onto Bitcoin, enabling fast stake unbonding and composable trust. The timestamping protocol ensures that PoS chains can borrow Bitcoin’s security as a timestamping server, reducing security costs and enhancing cross-chain security [15].

Babylon’s Bitcoin Data Availability Protocol uses Bitcoin’s limited block space for critical tasks, such as providing a censorship-resistant layer for PoS chains. This protocol safeguards the decentralized world against censorship by leveraging Bitcoin’s secure and censorship-resistant storage capabilities.

Babylon’s three-layer architecture consists of Bitcoin serving as the timestamp server, Babylon acting as the intermediary layer, and the PoS chains as the demand layer. This design allows Babylon to receive checkpoint streams from multiple PoS chains, merge these checkpoints, and publish them on Bitcoin, ensuring robust security and synchronization [16].

[13]

[13]

Babylon can receive checkpoint streams from multiple PoS chains and merge these checkpoints to publish them on Bitcoin. By utilizing aggregated signatures from Babylon validators, the checkpoint size is minimized, and the frequency of these checkpoints is controlled by allowing Babylon validators to change only once per epoch. Validators from various PoS chains download Babylon blocks to verify if their PoS checkpoints are included in the Bitcoin-verified Babylon blocks. This enables PoS chains to detect discrepancies, such as if Babylon validators create an unavailable block verified by Bitcoin and lie about the PoS checkpoints contained within it [17].

The main components of the protocol include checkpoints, canonical PoS chains, withdrawal rules, slashing rules, and unavailability pausing rules. Checkpoints consist of the block’s hash and a single aggregated BLS signature, corresponding to the signatures of the two-thirds majority of validators who signed off on the block for finality. PoS blocks can assign Bitcoin timestamps through Babylon checkpoints [17].

[18]

[18]

In terms of purpose, while Babylon is similar to Eigenlayer, it is not a simple fork of Eigenlayer. Given the current inability to natively use Data Availability on the Bitcoin main chain, Babylon’s presence is significant. This protocol not only brings security to external PoS chains but also revitalizes the BTC ecosystem internally [16].

[13]

Babylon is convenient for users as it allows Bitcoin holders to stake their BTC, securing PoS networks without requiring a bridge or third-party custody. Yet, there are challenges facing the design of Babylon.

One challenge would be the checkpoint accuracy, as ensuring the timely and accurate inclusion of checkpoints in the Bitcoin blockchain is critical. Any delay or inaccuracy can compromise the security and reliability of the entire system. The current solution is the use of Vigilante Relayers and a robust Monitoring Suite helps mitigate these risks by constantly verifying and submitting checkpoint data, as mentioned above.

Another key challenge would be implementing a fully slashable security model that effectively penalizes security violations while ensuring honest participants can withdraw their funds without delay. This is currently solved by Babylon by employing advanced cryptography and a well-defined staking protocol to ensure security violations are detected and penalized accurately, maintaining the integrity of the PoS chains.

Finally, integrating Babylon with multiple PoS chains and maintaining seamless cross-chain communication can be complex. The current solution of Babylon is the use of IBC and comprehensive monitoring tools helps manage interoperability and ensure data consistency across different blockchain networks.

Growth

Babylon Chain has demonstrated strong growth potential, evidenced by its successful $18 million Series A funding round led by Polychain Capital and Hack VC in late 2023. Binance Labs, the venture capital and incubation arm of Binance, has also invested in Babylon Chain to support the advancement of Bitcoin staking [19]. Moreover, Babylon has successfully closed a $70 million funding round led by Paradigm, with significant contributions from Bullish Capital and Polychain Capital. This pre-launch funding aims to support team growth, research, and development ahead of Babylon’s mainnet launch, pivotal in accelerating the development of Babylon’s Bitcoin staking protocol. Simultaneously, the platform is committed to exploring new scaling solutions, improving security features, and expanding interoperability capabilities [20].

In terms of development, further refinement of the checkpointing mechanism is anticipated, ensuring that Babylon's security protocols remain robust. This involves anchoring Babylon blocks to the Bitcoin blockchain, providing a secure timestamping service that enhances overall security. Continuous improvements in scalability and security are expected, ensuring that Babylon can handle increasing transaction volumes without compromising on security. This includes enhancing the checkpointing process and refining the hybrid PoS-PoW consensus mechanism

Moreover, Babylon could aim to bolster its cross-chain communication features. Improved interoperability will allow for seamless data transfer and integration between different blockchain networks. Another plausible direction to take would be by expanding use cases, for instance in decentralized finance or other enterprise applications. Babylon’s scalable and secure infrastructure is well-suited for these high-demand sectors. This would be further explored.

In terms of growth, Babylon Chain's primary market potential lies in its ability to harness Bitcoin's security and liquidity for PoS networks. At the same time, Babylon's Bitcoin staking protocol enables PoS chains to enhance their security by staking Bitcoin. This protocol not only provides additional security layers but also helps PoS networks attract capital through Bitcoin staking. By doing so, Babylon reduces inflationary pressures on PoS chains and strengthens their overall security framework.

Babylon is poised to become a key player across multiple blockchain ecosystems, particularly within the Cosmos network. Its ability to provide decentralized security services will be critical in driving adoption and integration across various blockchain platforms. Babylon's interoperability features allow it to facilitate seamless data transfer and communication between different blockchain networks. This cross-chain functionality is crucial for the growth and integration of the broader blockchain ecosystem.

Ecosystem

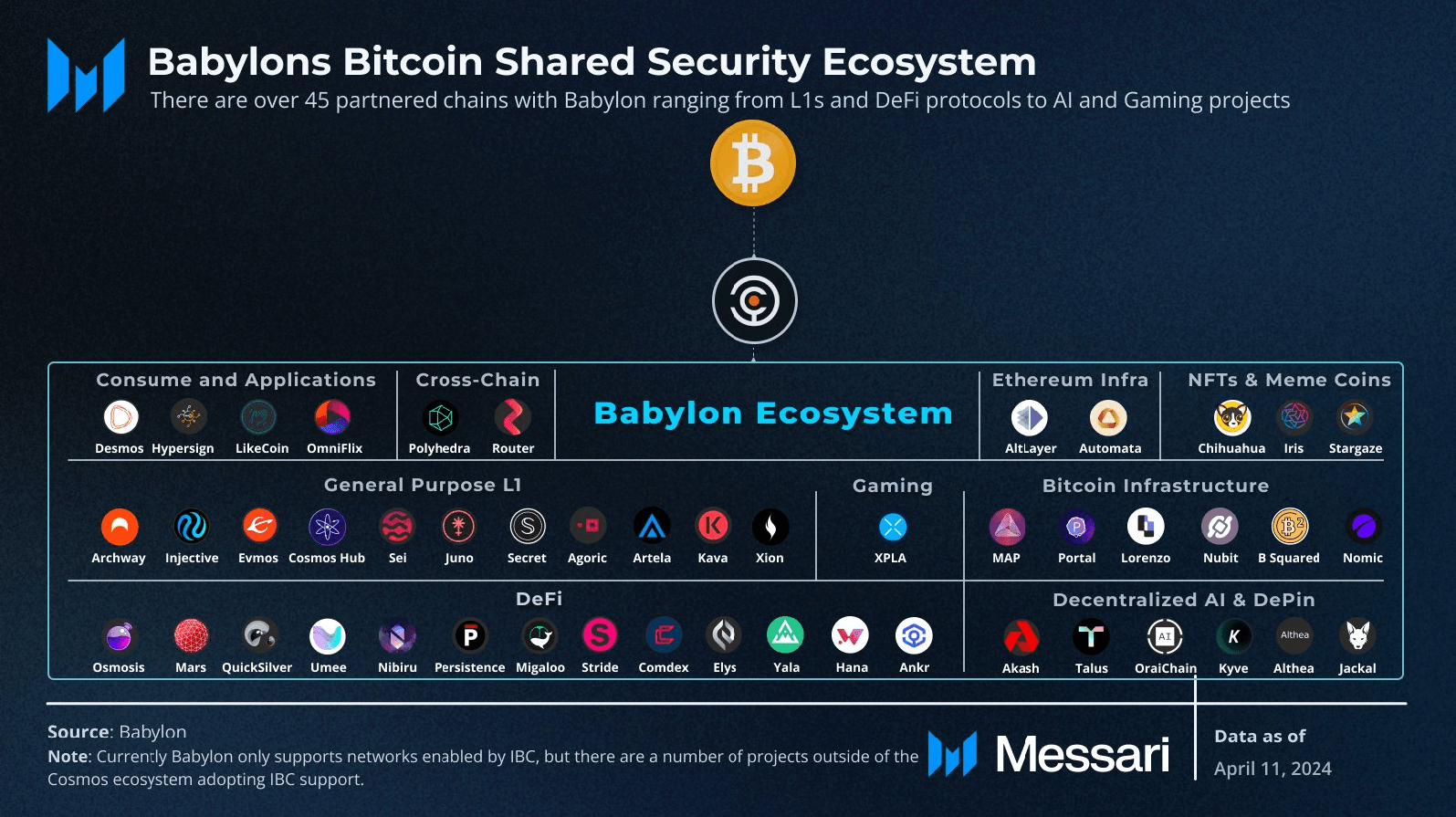

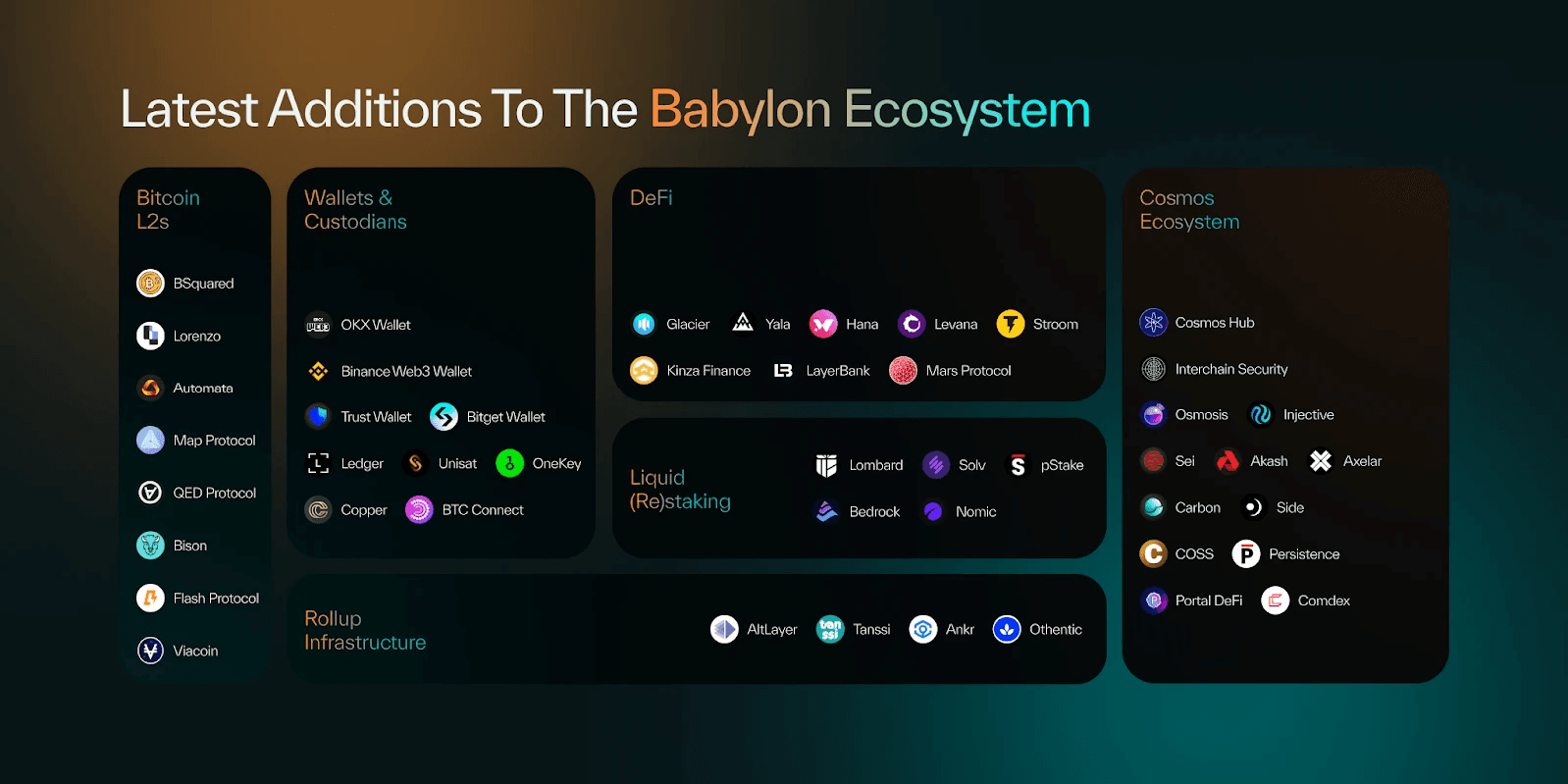

There are currently 51 projects within the Babylonchain ecosystem, categorized into BTC L2s, DeFi, Liquid (Re)staking, Wallets and Custodians, Cosmos Ecosystem, Finality Provider, and Rollup Infrastructure. Most of these projects are designed to leverage the unique features of Babylonchain.

[21]

[21]

The projects within the ecosystem can be further classified into seven categories.

The Staking and Validators category includes projects that provide staking services and secure blockchain networks, such as 01node, B-Harvest, Chorus One, Imperator, Notional, Polkachu, and WhisperNode. The DeFi category features projects that offer financial services like liquidity provision, leveraged trading, and credit protocols, including Mars Protocol, Comdex, Nomic, Persistence, Levana, and LayerBank. The Interoperability and Bridging category comprises projects like AltLayer, Map Protocol, BTC Connect, and Nomic, which enable seamless interaction between different blockchain networks.

In the Infrastructure and Development Tools category, projects such as Akash Network, Tanssi, Nodes Guru, and Dora Factory provide cloud services, infrastructure protocols, and development resources. The Security and Privacy category focuses on security measures, privacy protocols, and asset management solutions, with projects like QED Protocol, Copper, and Kinza Finance leading the way. The Wallets and Asset Management category includes platforms like Binance Web3 Wallet, OKX Wallet, Trust Wallet, and Bitget Wallet, which facilitate the storage, management, and trading of crypto assets. Finally, the Specialized Protocols category caters to niche applications like Bitcoin NFTs, DeFi on Bitcoin Layer 2, and liquid staking, with projects such as Flash Protocol, UniSat, Bison Labs, and Stroom [22].

The BabylonChain ecosystem boasts a broad range of services encompassing staking, DeFi, infrastructure, and interoperability. It integrates innovative solutions with protocols for rollups, zk-proofs, and cross-chain communication. Emphasis on privacy and robust asset management underlines the ecosystem's strong security features.

However, an area for continuous improvement regarding mainstream adoption would be user-friendly applications, which are crucial for engaging a broader audience. Additionally, there are limited educational resources for new users and insufficient integration with traditional finance systems, which could bridge the gap between blockchain and conventional financial infrastructures.

[23]

[23]

Opportunities

Babylon Chain presents a versatile and robust infrastructure capable of supporting a wide array of applications across various sectors. By leveraging its unique features, Babylon can enhance existing blockchain use cases, providing increased security, scalability, and cost-effectiveness. Below are some potential applications across different sectors that could greatly benefit from the integration of Babylon Chain.

Babylon Chain’s integration with Bitcoin introduces significant advantages within the DeFi sector. By anchoring its blocks to the Bitcoin blockchain through checkpointing, Babylon ensures that DeFi applications benefit from Bitcoin’s robust security model, effectively reducing the risk of hacks and exploits that are prevalent in the DeFi ecosystem. Babylon's cross-chain capabilities further enhance this by enabling DeFi applications to interact seamlessly with multiple blockchain networks, fostering a more integrated and liquid ecosystem crucial for the sector's growth. One of the major challenges in DeFi is the high transaction fees, particularly on networks like Ethereum. Babylon’s integration of layer 2 scaling solutions allows for maintaining low transaction fees while handling a high volume of transactions. This feature is essential for DeFi platforms where transaction costs significantly impact user adoption and profitability.

By offering lower fees, Babylon can attract users looking for cost-effective alternatives, thus promoting broader adoption of DeFi solutions. For example, high Ethereum gas fees have driven users to layer 2 solutions like Polygon. Additionally, Babylon can facilitate cross-chain lending and borrowing, where users can leverage assets from different blockchains securely. For instance, a decentralized lending platform similar to Aave could be built on Babylon, allowing users to deposit Bitcoin and use it as collateral to borrow assets on other blockchains. This cross-chain functionality enhances liquidity and expands financial services within the DeFi space.

Moreover, Babylon could host a stablecoin platform similar to Tether or USD Coin, issuing stablecoins backed by Bitcoin reserves. This would combine Bitcoin’s security with the stability of fiat currencies, providing users with a reliable medium for trading, lending, and other financial activities within the Babylon ecosystem. The introduction of Bitcoin-backed stablecoins on Babylon could attract users seeking a stable and secure asset within the volatile cryptocurrency market, especially given that stablecoins have become essential in the crypto market, with USDT market cap exceeding $100 billion [24]. Babylon's infrastructure could also support cross-chain payment systems similar to Ripple, enabling cross-border transactions using blockchain technology. Such a system could leverage Bitcoin’s security for enhanced transaction integrity while offering lower fees and faster settlement times, making it an attractive option for global payments.

In terms of interoperability, Babylon could support projects similar to Thorchain, a cross-chain liquidity protocol that allows users to swap assets across different blockchains without intermediaries. Babylon’s similar security model, enhanced by Bitcoin, could ensure secure cross-chain interactions. Furthermore, Babylon could draw inspiration from Polkadot to facilitate cross-chain transfers of various types of data or assets, not just tokens. This capability would create a more integrated and liquid ecosystem, essential for the blockchain industry's evolution. Polkadot’s ecosystem has seen significant growth, with over 350 projects building on its network as of 2023 [25], highlighting the demand for interoperable blockchain solutions.

Babylon’s approach to maintaining low fees while handling high transaction volumes could also pave the way for projects similar to Polygon, which provides layer 2 scaling solutions to reduce transaction fees on the Ethereum network. By offering a cost-effective alternative, Babylon could drive significant user adoption, particularly among those deterred by high Ethereum gas fees.

Another potentially promising DeFi application on Babylon could be decentralized insurance policies, where users purchase coverage for various risks, with claims processed automatically through smart contracts. A potential model could be Nexus Mutual, a decentralized insurance protocol providing coverage for smart contract failures. Babylon’s robust security, backed by Bitcoin, could support similar insurance applications, tapping into the growing decentralized insurance market, which has seen Nexus Mutual covering over $400 million in assets [26].

Babylon Chain's scalable and secure infrastructure makes it an ideal platform for various enterprise applications, for instance in the direction of supply chain management and digital identity verification. By utilizing Babylon’s blockchain, enterprises can achieve transparent and traceable supply chain processes, enhancing operational efficiency and trust. For instance, a food company could use Babylon to track the journey of produce from farm to table, with each step recorded on the blockchain, reducing fraud and improving accountability. The global cold chain market, which was valued at $233 billion in 2020, is expected to grow significantly, highlighting the need for reliable monitoring solutions [27], something Babylon can provide by ensuring data integrity and traceability using Bitcoin’s security.

In digital identity, Babylon could support secure and decentralized identity verification processes, crucial for enhancing security and privacy in digital interactions. As the digital identity solutions market grows, expected to increase from $13.7 billion in 2021 to $30.5 billion by 2025 at a CAGR of 17.3% [28], Babylon’s secure identity verification can tap into this expanding market, offering a reliable alternative to traditional methods. Babylon’s infrastructure could also be leveraged for logistics optimization platforms, where smart contracts automate real-time tracking and other logistics operations, reducing delays and improving efficiency. The logistics industry, a multi-trillion-dollar market, presents significant potential for blockchain integration to streamline operations and reduce costs.

Furthermore, Babylon could offer solutions similar to IBM Blockchain’s initiatives with automotive companies to improve supply chain transparency and efficiency. By tracking parts and verifying their authenticity on the Babylon blockchain, enterprises can reduce counterfeiting and ensure quality control. In the financial sector, Babylon could be utilized for KYC processes, where users’ identities are verified on the blockchain, reducing the risk of identity theft and fraud. For instance, a decentralized identity verification solution similar to Civic could be implemented on Babylon, allowing users to manage their digital identities securely.

Babylon could also support secure medical records management, enabling patients and healthcare providers to access and share medical records with all access logged on the blockchain. This would ensure privacy and accountability, crucial in the healthcare sector. The global electronic health records market is expected to reach $43.36 billion by 2030, driven by the need for secure and efficient data management systems [29]. Additionally, Babylon could facilitate the issuance of certificates as NFTs, ensuring their authenticity and preventing fraud.

This could be particularly useful in education, where institutions could issue tamper-proof credentials on the blockchain, enhancing transparency and trust in the sector. The global education technology market is expected to reach $404 billion by 2025, and blockchain-based credentialing can play a key role in this growth [30].

Finally, Babylon could streamline property title management and lease agreements, reducing fraud and improving efficiency in real estate transactions. By recording property titles and lease agreements on the blockchain, Babylon could offer a secure and verifiable platform for managing these critical assets. The global real estate market, expected to reach $4,263.7 billion by 2025, presents a significant opportunity for Babylon to enhance transparency and efficiency through blockchain technology [31].

Babylon’s infrastructure is particularly well-suited for NFT marketplaces and blockchain-based gaming applications due to its ability to handle a high volume of transactions quickly and cost-effectively. This capability is crucial for enhancing the user experience in these sectors, where fast transaction times and low fees are essential. An NFT marketplace on Babylon could offer users a seamless experience for minting, buying, and selling NFTs without the high gas fees typically associated with Ethereum-based platforms. The NFT market generated over $10 billion in trading volume in Q3 2021 [32], and by providing a more scalable solution, Babylon could capture a significant portion of this market.

In the gaming sector, Babylon’s high throughput and low transaction fees are vital for creating blockchain-based games where fast and seamless transactions are crucial for user engagement. The global gaming market is expected to generate revenues of $189.3 billion in 2024 [33], with blockchain gaming poised to capture a growing share of this market. For example, a blockchain game similar to Axie Infinity could be developed on Babylon, allowing players to earn tokens and trade in-game assets securely. Axie Infinity’s success illustrates the demand for fast and cost-effective transactions, a need that Babylon can meet with its high throughput and low fees, enhancing the overall gaming experience and making Babylon a competitive choice in the rapidly growing blockchain gaming market.

Conclusion

Babylon has immense potential to revolutionize multiple sectors by offering a secure, scalable, and cost-effective blockchain infrastructure. Whether in the rapidly growing DeFi space, enterprise applications, or the NFT and gaming markets, Babylon's integration with Bitcoin and its innovative features position it as a powerful platform for developing next-generation blockchain solutions. By addressing current challenges in security, scalability, and transaction costs, Babylon Chain can drive broader adoption and foster innovation across the blockchain ecosystem. It has the potential to create possibilities of "hanging gardens”, where a multitude of applications can flourish by tying to the robust, proven security of Bitcoin with the flexibility and scalability of PoS networks.

References

[1]: https://coinmarketcap.com/currencies/ethereum/

[2]: https://coinmarketcap.com/currencies/bitcoin/

[3]: https://everstake.one/blog/babylon-chain-the-bridge-to-btc-staking

[4]: https://flagship.fyi/outposts/bitcoin-economy/babylon-chain-the-bitcoin-staking-pioneer/

[5]: https://babylonlabs.io/blog/babylon-a-game-changing-approach-to-scaling-bitcoin

[6]: https://trustmachines.co/blog/what-is-babylon-the-newest-bitcoin-staking-protocol/

[8]: https://www.cryptochemistry.io/blog/babylon-bitcoin-staking-in-cosmos

[10]: https://babylonlabs.io/blog/checkpointing-babylon-to-btc

[11]: https://docs.babylonchain.io/docs/developer-guides/modules/submitter

[12]: https://daic.capital/blog/babylon-chain-technical-architecture

[13]: https://docs.babylonchain.io/papers/btc_staking_litepaper(EN).pdf

[14]: https://babylonlabs.io/learn

[15]: https://docs.babylonchain.io/docs/introduction/btc-timestamping

[16]: https://www.gate.io/learn/articles/comparison-between-babylon-protocol-and-eigenlayer/2868

[17]: https://medium.com/ybbcapital/babylon-how-does-it-unlock-bitcoins-security-value-7684d9481b5d

[18]: https://babylonlabs.io/blog/babylon-for-fast-stake-unbonding

[19]: https://www.binance.com/en/square/post/1160695807498

[20]: https://cryptoslate.com/babylon-secures-70-million-to-turn-bitcoin-into-pos-security-backbone/

[21]: https://x.com/BSquaredNetwork/status/1781678336525352993

[22]: https://babylonlabs.io/ecosystem

[23]: https://x.com/babylonlabs_io/status/1790749252626653360

[25]: https://medium.com/polkadot-network/polkadot-2023-roundup-7fe77d88f022

[26]: https://www.mjl.capital/blog-posts/protocol-deep-dive-nexus-mutual

[27]: https://www.linkedin.com/pulse/cold-chain-storage-distribution-market-size-analysis-wsg5f/

[28]: https://www.grandviewresearch.com/industry-analysis/digital-identity-solutions-market-report

[29]: https://www.grandviewresearch.com/press-release/global-electronic-health-records-market

[30]: https://www.holoniq.com/notes/global-education-technology-market-to-reach-404b-by-2025

[31]: https://www.linkedin.com/pulse/real-estate-market-size-worth-42637-billion-2025-sohan-potdar/

Latest writing

Get In Touch

If you have thoughts, project updates, or feedback to share, please reach out via email. We encourage all submissions to include a detailed description and the latest developments.

general@velocity.capital